2025 MENA cybersecurityStrategic Insight

By: Abdullah Al Dereai - 5 minute read

Cybersecurity is crucial in the rapidly evolving MENA digital market, projected to reach over USD 16.75 billion by 2025. Key sectors include cloud security, MDR, and data privacy, which help organizations protect, compete, and build trust.

Market Scale & Growth Trajectory

The MENA cybersecurity market is projected to reach USD 16.75 billion in 2025, with estimates ranging up to USD 20.55 billion, and is expected to grow at a CAGR of approximately 9.2% to 14.8% by 2030. For the broader Middle East and Africa (MEA) region, revenue stood at USD 16.54 billion in 2024, with a forecasted CAGR of 12.1% through 2030

Growth Drivers & Market Forces

Digital transformation

The proliferation of AI-powered attacks

Digital transformation

In energy, finance, and smart infrastructure, plus regulatory mandates (e.g., UAE NESA, KSA ECC), drive security demands.

Geopolitical threats

The proliferation of AI-powered attacks

Digital transformation

Including state-sponsored attacks and organized cybercrime as forecasted global damage (~$10.5 trillion by 2025), amplifies urgency.

The proliferation of AI-powered attacks

The proliferation of AI-powered attacks

The proliferation of AI-powered attacks

Is matched by AI-driven defense innovation; global sector investment projected to reach nearly $135 billion by 2030

Segment Evolution & Deployment Patterns

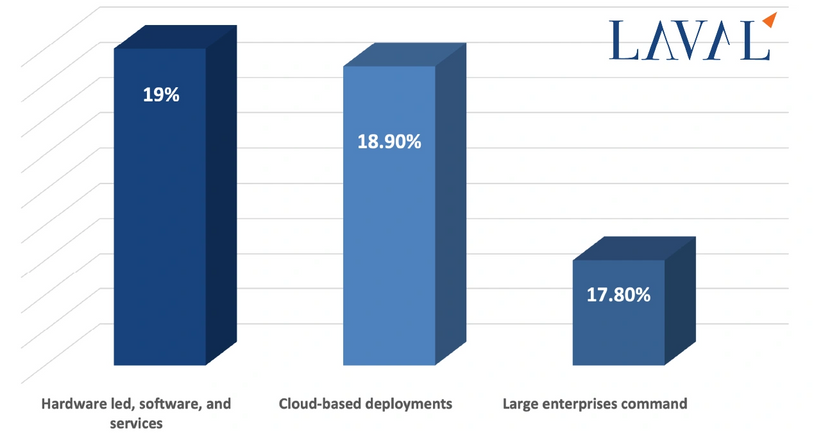

The above chart illustrates the growth trajectories of various segments in 2024, featuring distinct lines for the hardware-led, software, and services sectors, each exhibiting a compound annual growth rate (CAGR) of 19%. Additionally, cloud-based deployment segments, which are expected to show an 18.9% CAGR, should be highlighted. The chart should also illustrate market share distribution, with large enterprises occupying approximately 53%, and SMEs exhibiting a CAGR of 17.8%.

Sector & Country

Banking, Financial Services & Insurance (BFSI) held ~21.4% share in 2024, while healthcare is the fastest growing (20.6% CAGR).

UAE leads regionally with ~30% share in 2024.

Other key markets: Kuwait, Saudi Arabia, Qatar, and Oman, buoyed by national cyber initiatives.

Insights

At Laval, our vision is to be the leading business and management consulting firm in the industry, providing innovative solutions and unparalleled service to our clients.

We have a team of experts with diverse backgrounds and skillsets, allowing us to provide comprehensive consulting services to businesses of all sizes and industries.

We take a data-driven approach to consulting, utilizing the latest technology and tools to analyze and interpret complex data sets. This enables us to identify trends and opportunities that can help our clients achieve their business goals.

Strategic Value: From Protection to Value Creation

While cyber risk continues to pose a significant threat to critical infrastructure, finance, and healthcare sectors, a strategic shift is emerging among leading organizations. These entities are increasingly viewing cybersecurity as a vital enabler of digital transformation, M&A activity, and innovation initiatives. With enterprise cybersecurity expenditures projected to surpass USD 3.3 billion by 2025 and the broader MENA cybersecurity market expected to double by 2030, the financial stakes are escalating. This analysis explores the economic value generated by cybersecurity investments, sector-specific growth trajectories, innovative deployment models, and the expanding strategic role of CISOs as key business leaders underscoring cybersecurity's transition from a protective measure to a driver of measurable performance and value creation.

Market Outlook & Strategic Implications

The cybersecurity sector within the MENA region is experiencing robust growth, with total expenditures anticipated to surpass USD 20 billion by 2025. Projections indicate potential expansion to a range of USD 26 billion to USD 41 billion by 2030, contingent upon the rate of adoption across the enterprise and government sectors. This upward trajectory is primarily driven by increased demand for sophisticated solutions, including cloud security, managed detection and response (MDR) which is projected to grow at a compound annual growth rate (CAGR) of approximately 22% globally and AI-driven threat defense systems. Additionally, the adoption of zero-trust architectures is gaining momentum, particularly among regulated industries and government infrastructure. Small and medium-sized enterprises (SMEs) are emerging as a rapidly expanding segment, with cybersecurity adoption expected to increase by 17–18%, supported by digital transformation initiatives, government funding, and the proliferation of fintech platforms. These trends reflect a maturing cybersecurity landscape in the MENA region, presenting significant opportunities for investors, technology providers, and policymakers committed to fostering digitally resilient economies.